Awesome Info About How To Appeal Cook County Property Tax

The county assessor accepts appeals to property assessment, classification, or exemptions and oversees decisions reached for changes.these appeals are accepted for the following classes.

How to appeal cook county property tax. The assessor assesses all real estate located throughout the county and establishes a fair market value for each. Every single property in cook can file an appeal. You can appeal to the.

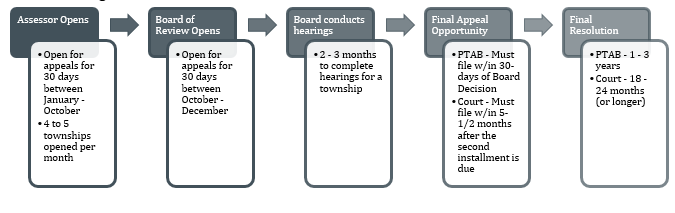

For residential property, this is usually 10% of the estimated market value. The viewer allows you to set various filters to refine your search. If you do not agree with the county board of review's decision, you can appeal the decision (in writing) to the state property tax appeal board or file a tax objection complaint in circuit court.

The assessed value of your home is the amount used to calculate your property taxes. Check to see if your township is open for appeals. Once you are ready, you or your legal counsel must file your appeal with the cook county.

Billed amounts & tax history. Even if you missed the deadline for this year, it is never too early to start researching and collecting data to build a successful case for your property tax appeal. To support an appeal based on incorrect information in the property's characteristics, such as incorrect square footage, you are encouraged to submit supporting documentation with your.

You can file an appeal with the cook county board of review; Identifying your pin the first step to filing an appeal is figuring out which property you want to file an. To attach comparable properties with your appeal requires some specific steps.

Ptap board (rumored to to be working on. Check to see if your township is open for appeals. First, file an appeal of your property tax assessment with the cook county assessor's office.

.png)

.png)